Cask or Bottle? Whisky Investment Explained

Victoria O'Brien

Head of Content at London Cask Traders

Discover the key differences between investing in bottles and cask whisky.

Most whisky investment stats you’ll find – including those quoted in the Knight Frank Luxury Investment Index – are based on bottle sales. Why? Because single bottles are constantly being traded at auction globally, and the data is public. Casks, on the other hand, are more often sold privately, and require deeper insight to understand.

This blog explores the key differences between investing in bottles versus casks, and why understanding the market beyond headline auction prices is essential for making a truly informed decision.

Casks v Bottles - Investment Profile

• Casks mature over time, increasing in value as the whisky improves.

• Bottles are static, they don't age once sealed.

• Cask value grows from maturation of the spirit itself.

• Bottle value grows from brand marketing, rarity and packaging.

Put simply: Casks are about ageing and value. Bottles are about story and show.

Age before Beauty

Whisky investment is often presented as glamorous and lucrative – especially when million-dollar bottles make the news. But those headline-grabbing auctions only tell part of the story.

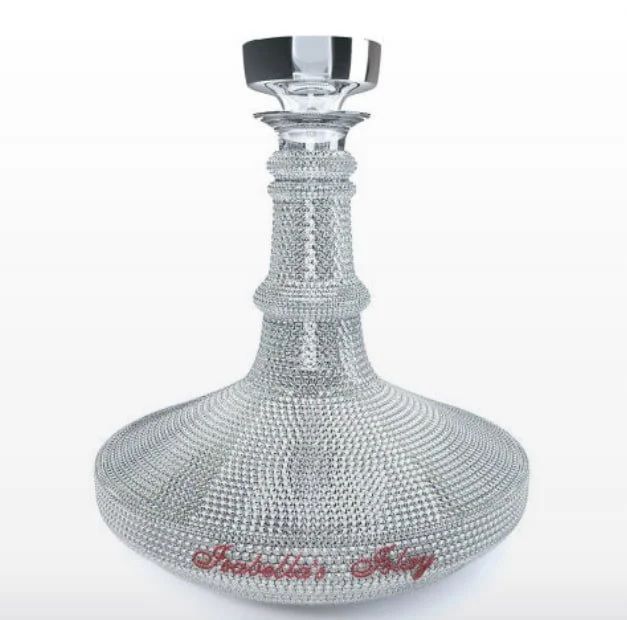

There's a glamour to fine and rare whisky bottles that's hard to deny. Open any auction catalogue or flip through a luxury lifestyle magazine and you'll find glittering names like Macallan, Dalmore or Glenfiddich with price tags that soar into the six and seven-figure range, presented in artist-designed bottles occasionally studded with diamonds. It's easy to assume this is where the smart money is. Bottles are visible, tradeable and in many ways more seductive.

But beneath this glossy surface, whisky casks have been steadily outpacing bottles, offering longer-term, less volatile investment returns. Cask whisky investment isn't about flipping hype-laden limited editions in fancy packaging. It's about patience, provenance and tangible growth, alongside very specific and clear capital gains tax benefits. For a growing number of investors, casks present the more grounded, age-related and smarter way to invest in whisky.

Beyond the Hype: Not all Whisky is Bottled Equally

Let's start with what many people see: headlines. An infamous Isabella's Islay bottle sold for a reported $6.2 million (luxedb.com) – but that was never about the whisky. The bottle itself was encrusted with diamonds and rubies, and the 30-year-old whisky inside worth perhaps $200,000. It's a high price for a bottle of whisky, and a misleading one.

As Oliver Court, managing director at London Cask Traders, explains:

'A lot of these headlines create unrealistic expectations. People assume all fine and rare whisky bottles carry these prices, but bottled whisky is a very different kind of asset to casks – bottles are more collectible than investment-grade, and much more volatile.'

The Allure (and Limitations) of Bottles

• Bottles offer immediate ownership and more online auctions.

• The barrier to entry is lower – some investment-grade bottles start at a few hundred pounds.

• However, once bottled, whisky stops ageing meaning no further value is added through maturation.

• Market prices can be volatile, driven by collector trends rather than intrinsic improvement of the spirit.

Bottled whisky investment does have some advantages. Despite headline-grabbing prices at the high-end market, the entry price point is relatively low, with individual bottles ranging from less than a hundred pounds to a few thousand. You can buy online, and immediately re-auction or drink bottled whisky. For the casual enthusiast or hobbyist investor, this flexibility can be appealing.

But bottles also have limitations. Once whisky is bottled, it stops maturing. Its value becomes solely dependent on external factors – including rarity, packaging and market sentiment.

Casks: Where Whisky Keeps Growing

In contrast, whisky in casks continues to evolve. The longer it sits in the barrel, the more it matures – chemically, in flavour, and financially. That's why many cask investors often focus on 'new make' spirit – whisky that hasn't begun ageing yet. Why? Because there's a clear leap in value once the whisky can be legally defined as Scotch (around 4 years) and again at various stages (4-8 years young whisky; 8-12 years benchmark; 12 years + vintage), and it's these maturation milestones that offer the highest potential margins.

This simple difference is at the heart of why cask whisky as an alternative asset class, appeals to serious long-term investors. Buy early, hold long and let time do its work.

As we've mentioned, most of the whisky market analysis refers to bottles, but more reliable data for casks is emerging. Platforms like the BC20 Whisky Cask Index showed that in 2022, casks tracked by the index outperformed bottles, gold and even the S&P 500. (Scottish Financial Review)

Some standout cask investments included:

• Laphroaig: +18.75%

• Staoisha (Bunnahabhain): +17.74%

• Highland Park: +17%

Bottles vs Barrels: What Kind of Investor Are You?

For those who prefer a more hands-on, tax efficient and arguably more authentic exposure to whisky's real value creation, casks have very clear advantages.

But casks aren't for everyone. They require patience – this is not a six-month flip, and maximum profits are achieved by holding casks 5-10 years plus. Additionally, there are fewer recorded auction sales for casks than bottles, although specialist brokers like London Cask Traders provide an increasingly strong secondary market through both auctions and private sales.

Here's a short, helpful comparison:

\ BOTTLED WHISKY CASK WHISKY

Maturation None after bottling Ongoing until bottled

Added Value Rarity, brand, packaging. Age, cask type, maturation

Risk of Fraud Higher (counterfeits common) Lower (HMRC certification)

Tax CGT liable CGT exempt

Investment Term Short, medium, long Medium - Long (5-10+yrs)

Storage DIY or private vault Bonded warehouse (insured)

Distillery Dynamics and Emerging Names

One of the main misconceptions about cask investment, is that only well-known distilleries matter. Unlike bottles, with casks you are investing in the distillery itself, not simply the branding or name.

'There is some amazing new make (raw spirit) being produced by smaller, less well-known distilleries,'

confirms Oliver Court.

'A lot of these have either been reopened or just started. They produce less in quantity – but in many ways that's an advantage. If you're willing to invest early you could see real growth as they establish themselves.'

The Final Cask Conclusion

CaskCasks offer a more involved process of maturation than bottles, and the flexibility of 'finishing'. This process involves 're-racking' – transferring the whisky into a different cask and wood type, often ex-Port or Sherry barrels – allowing different flavour profiles to emerge, further increasing value for future resale or bottling.

While both cask and bottle investments have their merits, cask investments generally offer:

• Higher Potential Returns: Due to ongoing maturation and increasing scarcity.

• Tax Efficiency: Exemption from Capital Gains Tax in UK jurisdictions.

• Market Stability: Reduced susceptibility to short-term market fluctuations.

Cask investments require a longer-term commitment and higher initial capital than bottles. Selling requires more planning, often via reputable brokers, auction houses or private channels. Unlike bottles, casks should not be considered as a short-term investment, or a collector's item.

However, if you choose wisely, understand the fundamentals and simply allow time to add value – the potential for profit in casks is considerable.

Victoria O'Brien

Head of Content at London Cask Traders