Reduced Tariffs on Whisky as UK and India Strike Historic Trade Deal

Victoria O'Brien

Head of Content at London Cask Traders

UK and India Trade Deal: A Defining Moment for Scotch Whisky

A long-awaited free trade agreement between the UK and India has been finalised, and it delivers exactly what Scotch whisky producers and investors have been hoping for: a drastic cut in tariffs on Scotch whisky exports to one of the world's largest and fastest growing markets.

India's tariffs on UK whisky will be halved from 150% to 75%, before reducing to 40% in the tenth year of the deal, according to the Department for Business and Trade. (Source:Gov.UK)

It's the biggest and most economically significant trade deal the UK has negotiated since Brexit, with Scotch whisky a winner and prime motivator. The deal will help ease concerns and boost confidence in the industry at a critical moment, following Trump's recent U.S. tariffs. (BBC.co.uk)

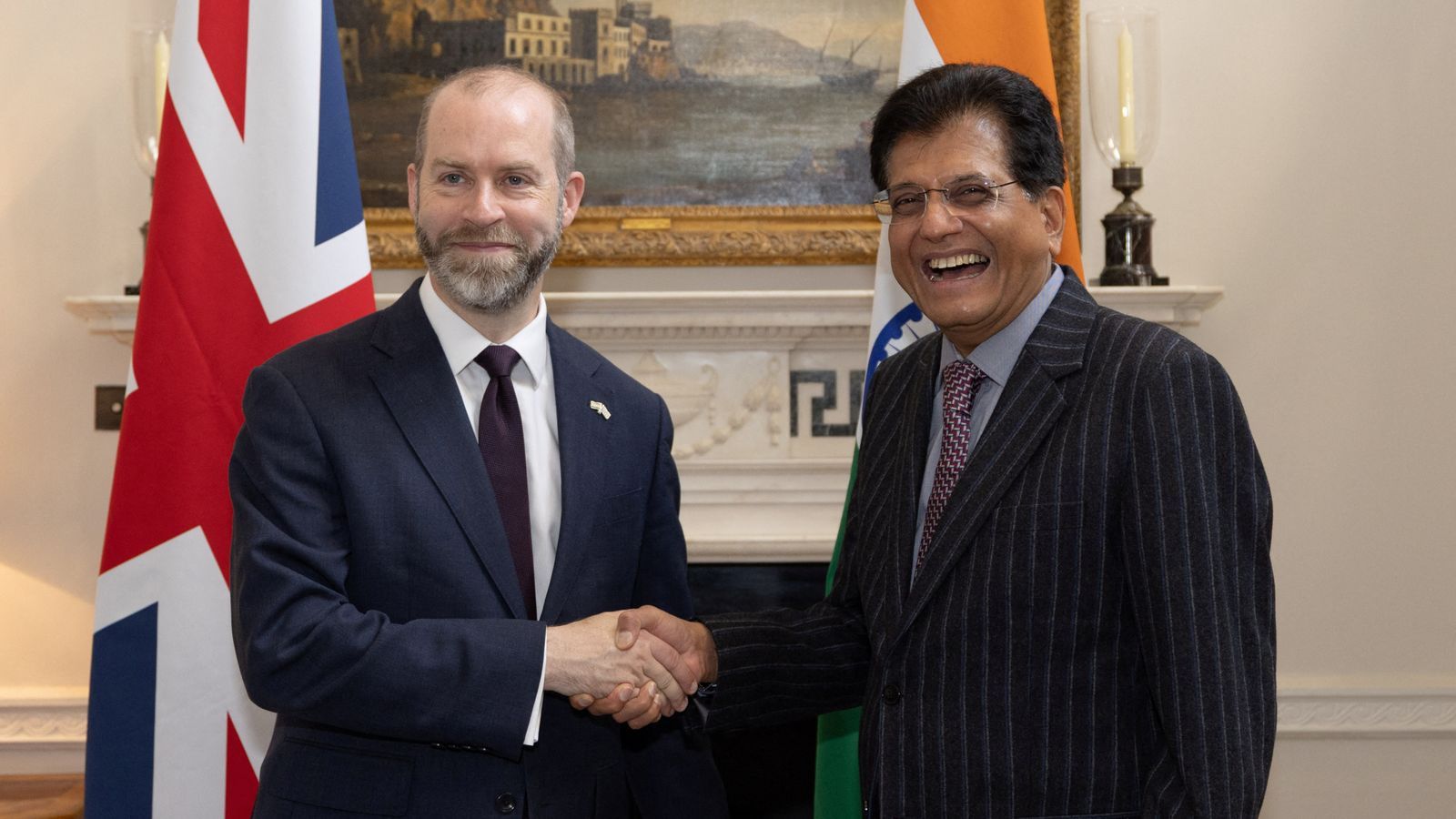

Main image: Jonathan Reynolds welcomes Indian minister of commerce and industry Piyush Goyal for trade talks. Pic: Reuters

A Landmark Agreement: with huge benefits

This landmark agreement for Scotch whisky provides huge benefits in terms of global export sales set to play out over the years ahead. India is already the world's largest whisky-consuming country by volume, and on track to become the third-largest economy globally.

Here's what this deal means in real terms for Scotch whisky producers, independent bottlers and those investing in casks:

• A potential £1 billion boost in Scotch exports to India over the next five years, according to the Scotch Whisky Association. (Source: SWA)

• Stronger international positioning for Scotch, including blends with single malts, in India's booming middle-class luxury market.

• Positive implications for cask investment returns, as bottlers seek to secure more mature stock for an increasingly sophisticated global customer base.

A Timely Boost for Scotch: a Growing Global Market

The timing couldn't be better. William Bain, head of trade policy at the British Chamber of Commerce, said: 'Against a backdrop of mounting trade uncertainty across the globe, these tariff reductions will come as a big relief.'

Scotch whisky in particular benefits from the deal, as UK companies exporting to India will have a clear edge on their European and U.S. counterparts when it comes to increasing sales.

A Transformational Trade Deal

The Scotch Whisky Association (SWA) has been advocating this deal for a while now, but it's taken three years of negotiations and the failure of three previous Prime Ministers – Boris Johnson, Liz Truss and Rishi Sunak – for Keir Starmer to finally get the deal over the line.

Mark Kent, CEO of the Scotch Whisky Association, welcomed the 'transformational' deal saying: 'The UK-India free trade agreement is a once in a generation deal and a landmark moment for Scotch Whisky to the world’s largest whisky market.'

He noted that the deal was good for India too, boosting federal and state revenue by over £3bn annually, providing discerning consumers in a highly educated whisky market far greater choice from Scotch whisky producers, who will now have the opportunity to enter the market.

Kent concluded: 'The reduction of the current 150% tariff has the potential to increase Scotch Whisky exports to India by £1bn over the next 5 years.' (Source: SWA)

For cask investors, the positive impact could run even deeper and longer.

What It Means for Cask Whisky Investors

Cask whisky investment is built on the principle of long-term value growth, tied to global demand for aged stock. India’s tariff reduction not only increases the number of consumers who can afford bottled Scotch – it encourages bottlers to ramp up their sourcing of aged spirit, including blends and increasingly single malts, to meet the coming wave of demand.

Here’s how this could play out for cask investors:

1.) Rising Bottling Demand - Popular brands and independent bottlers may accelerate purchases of maturing casks to bottle and export into India’s growing premium whisky segment.

2.) Upward Price Pressure on Mature Stock - Increased competition for aged spirit could boost prices on casks, particularly 8–15-year-old blends that align with India’s existing preferences and price points (see below).

3.) Enhanced Exit Opportunities - With more bottling firms targeting Indian distribution, cask investors may enjoy stronger secondary markets and more flexible selling windows.

4.) Alignment with Long-Term Investment Horizons - Given that many cask strategies span 8–12 years, the phased tariff reduction to 40% by year 10 aligns well with maturation timelines - especially for those currently holding casks or buying into the market in 2025.

India’s Whisky Market: Blends Rule, Malts Are Rising

India is Scotch whisky’s biggest export market by volume. In 2024 alone, over 192 million bottles of Scotch were shipped there – up 14.6% on 2023 and up a staggering 46.6% from pre-pandemic 2019. (Source: SWA)

Indian whisky drinkers still favour blends, although single malts are rapidly gaining status and popularity, particularly among younger professionals and a rising elite middle class.

However, the mainstream popularity of blends in India ties directly to the structure of many cask investment portfolios, which focus on maturing spirit from lesser-known distilleries used in these large-scale blends. Here are some names to look out for:

India’s Current Top 5 Scotch Brands (All Blends):

- 100 Pipers – Owned by Chivas Brothers, India’s #1 blend, featuring Speyside malts like Allt-a-Bhainne.

- Johnnie Walker – The global Scotch leader and India’s #2. The Blue Label is already a prestige symbol.

- Chivas Regal – Known for its Speyside-heavy blend, rapidly gaining ground in India’s urban centres.

- Ballantine’s – Light and accessible, it dominates everyday Scotch sales across India.

- Dewar’s – Featuring Highland malts like Aberfeldy, a recognisable and aspirational name in India.

The Bigger Picture: Diageo, and Global Economic Context

The scale and impact of this latest trade deal cannot be overstated. Its announcement triggered an immediate bump in global drinks brand Diageo’s share price – rising 2.5% before settling at 1.75% – as markets anticipated a boost in Scotch whisky revenues.

India’s alcoholic beverage market, currently worth an estimated $52.5 billion, is now forecast to reach $64 billion by 2028. This growth is driven by rising incomes, evolving tastes, and a preference shift toward premium imported spirits.

The UK–India trade agreement marks a generational shift in Scotch whisky’s global trajectory. For cask investors, it signals not only broader demand but deeper market access, especially for blends and younger malts poised to mature as tariffs fall.

Victoria O'Brien

Head of Content at London Cask Traders